Consider the following scenario: 2,000 roles at an expensive Manhattan HQ facility are to be reviewed with the intention of relocating around 25% of these roles to a cheaper location in Fort Worth, TX.

The one-off costs aside, this relocation is intended to lower the on-going operating costs by saving in two main ways:

- Salary costs are considerably lower in Fort Worth than Manhattan – say 20% lower – and so the employee costs for these 500 relocated roles will be lower; and

- Real estate costs in Fort Worth are also considerably lower – approximately one third the costs in the more expensive parts of Manhattan.

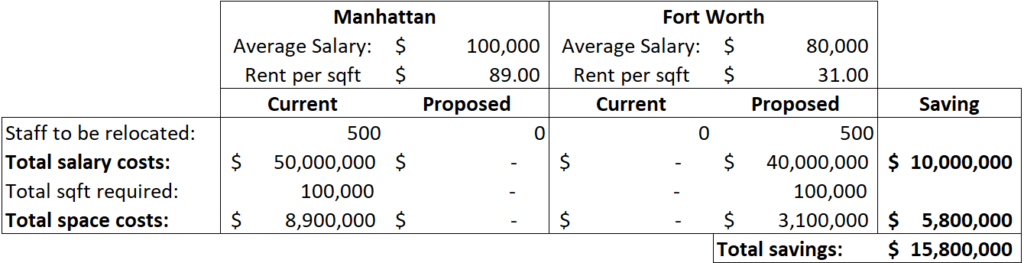

An initial estimate of the operating cost savings might therefore look something like this:

This shows that a total of $15.8M in operating costs can be saved by reducing the salary costs by $10M, and by the difference between the cheaper 100,000sqft required in Fort Worth compared to more expensive Manhattan space.

However, in reality, things don’t always work out as expected. In this example, on 15% of the roles could be relocated in the end, and the program itself led to an increase in presenteeism meaning that the Manhattan space could not be recovered.

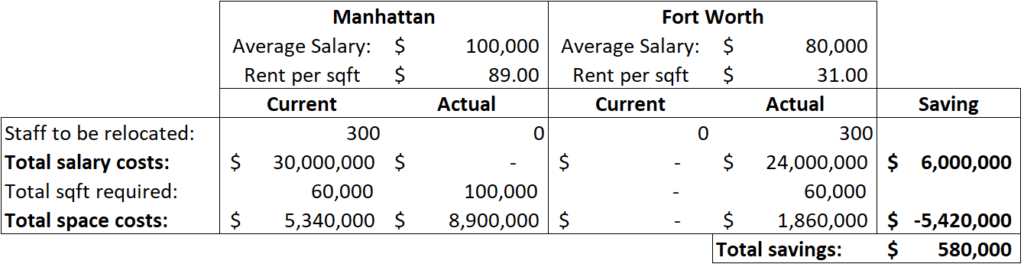

The overall result therefore looking like this:

As can be seen, the salary saving was reduced as only 300 staff were relocated, and the real estate space costs increased because the Manhattan space was still required, but an additional 60,000sqft was also required in Fort Worth to accommodate the 300 roles.

The net operating cost saving was less than 4% of that originally estimated.